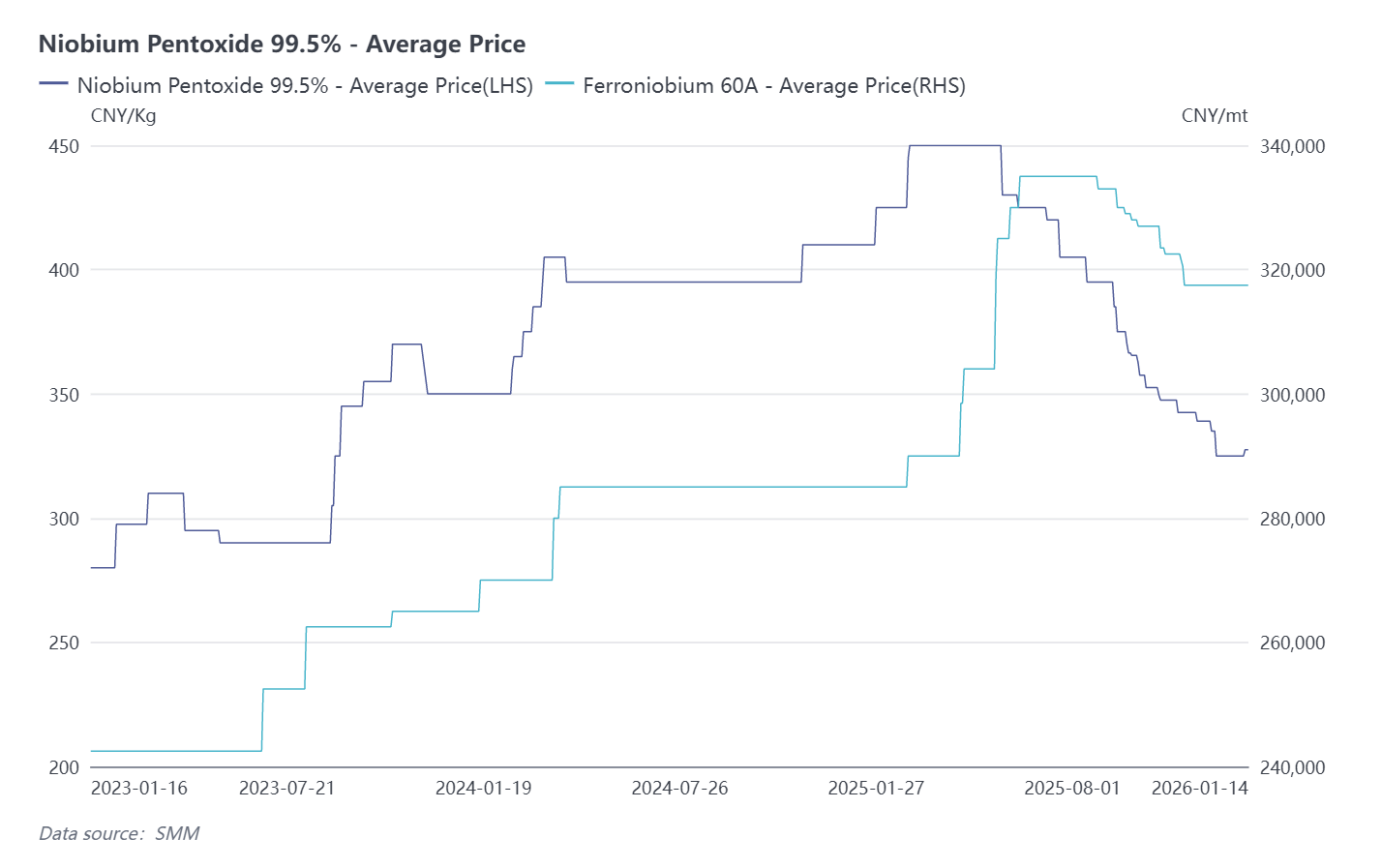

In 2025, niobium prices experienced a volatile trajectory characterized by an initial rally, followed by a correction, and then a stabilization—shaped first by geopolitical-driven sentiment, then by shifts in global supply-demand dynamics and downstream demand fluctuations, and finally by mild year-end supply tightness that sparked short-term adjustment expectations. The industry exhibited clear features of upstream resource concentration and downstream demand divergence.

At the beginning of the year, geopolitical tensions drove prices higher alongside tantalum. In February 2025, conflict erupted in the Democratic Republic of Congo (DRC). Initially, market sentiment had not fully materialized, and niobium prices remained firm. As the situation escalated, risk-averse sentiment intensified. Given that niobium is often co-produced with tantalum, niobium prices quickly followed tantalum’s upward trajectory. Notably, this price surge was primarily sentiment-driven rather than underpinned by actual supply shortages—planting the seeds for the subsequent pullback. Eastern DRC artisanal mines are predominantly tantalum-focused, with niobium produced only as a by-product; consequently, the region’s niobium output accounts for a negligible share of global supply. Brazil remains the dominant source of global niobium resources.

As the DRC situation gradually stabilized and supply clarity improved, niobium prices rationally retreated. Market sentiment normalized, and prices entered a downward trend. The key driver was the clear structure of global niobium supply—DRC’s marginal role meant its disruptions had limited systemic impact. Additionally, temporary weakness in downstream steel demand further pressured prices. As the primary end-use sector for niobium, sluggish steel industry activity amplified the downward momentum.

From August to mid-December 2025, the entire niobium chain trended lower, with ferro-niobium prices tracking declines in upstream raw materials such as niobium ore and niobium pentoxide. This phase was primarily driven by weaker-than-expected global macroeconomic recovery and persistently soft downstream demand. Excess global steel capacity, coupled with shifting international trade dynamics, weighed on steel prices in major exporting countries, indirectly dampening ferro-niobium procurement. Meanwhile, emerging applications—though advancing in areas like superconducting materials and next-generation batteries—remained insufficient to offset the shortfall from traditional steel-sector demand.

Starting in late December 2025, signs of tighter supply emerged, prompting upstream miners and smelters to raise quotations. Ferro-niobium was quoted at RMB 316,000 per metric ton, though no actual transactions were confirmed. This shift stemmed partly from year-end maintenance shutdowns at certain smelters, causing temporary capacity constraints, and partly from early restocking demand ahead of the new year. Furthermore, the DRC Ministry of Mines extended trading bans in select artisanal mining zones. While this had minimal direct impact on niobium supply, it reinforced market expectations for stricter compliance and upgrading of the tantalum-niobium supply chain, indirectly supporting tentative price stabilization.

In retrospect, the core narrative of niobium price movements in 2025 was that sentiment-driven spikes gave way to fundamentals. Short-term geopolitical disruptions ultimately yielded to the dominant influence of supply-demand realities. Looking ahead to 2026, niobium prices are expected to follow a “stable with upside potential” trend. Support will likely come from recovering global steel demand, China’s infrastructure investments, and advancements in high-end manufacturing. However, policy variables—such as potential adjustments to Brazilian export tariffs and implementation of new EU regulations—could introduce fresh volatility. Industry participants should closely monitor upstream supply stability and breakthroughs in emerging downstream applications to navigate market risks effectively.